CEO ECONOMIC OUTLOOK INDEX

Business Roundtable CEO Economic Outlook Index Dips Modestly

CEOs Say Maintaining a Competitive Corporate Tax Rate Is Important for Strengthening Domestic Manufacturing

Washington – Business Roundtable today released its Q1 2025 CEO Economic Outlook Survey, a composite index of CEO plans for capital spending and employment and expectations for sales over the next six months.

The overall Index dipped modestly by seven points from last quarter to 84, roughly at its historic average of 83. The small dip is the result of decreases in all three subindices and reflects moderation in CEO plans and expectations.

“The survey results signal that our members are cautious about the next six months, but also see opportunities to improve growth,” said Business Roundtable Chair Chuck Robbins, Chair and Chief Executive Officer of Cisco. “America’s leading CEOs know how critical it is to work with Washington to swiftly enact pro-growth policies that will drive domestic investment, innovation and job creation, and we are committed to these efforts.”

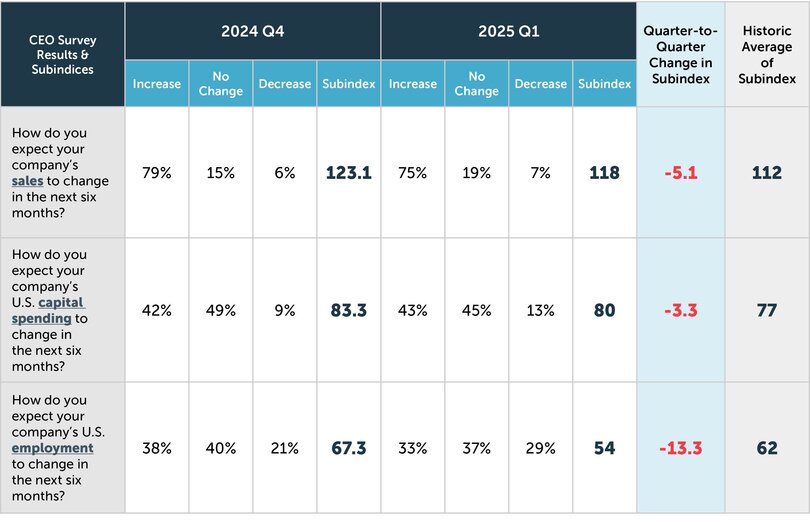

The Survey’s three subindices were as follows:

- Plans for hiring decreased 13 points to a value of 54.

- Plans for capital investment decreased 3 points to a value of 80.

- Expectations for sales decreased 5 points to a value of 118.

In their second estimate of 2025 U.S. GDP growth, CEOs projected 2.5% growth for the year.

“The modest dip in the CEO Economic Outlook Index is tied to several factors, including signs of economic headwinds and an atmosphere of uncertainty in Washington,” said Business Roundtable CEO Joshua Bolten. “Congress and the Administration can help turn the tide by moving swiftly to strengthen the Tax Cuts and Jobs Act (TCJA) and make the reforms permanent; scaling back overreaching regulations; reforming the permitting system; and avoiding the use of overly-broad, long-lasting tariffs.”

In a special question posed this quarter, CEOs were asked to identify policies and actions that are important for strengthening domestic manufacturing. Eighty-two percent of CEOs identified maintaining a competitive corporate tax rate. Seventy percent of respondents selected keeping tariffs low on intermediate inputs and raw materials, particularly those that cannot be sourced in the U.S., and 55% selected streamlining permitting and investing in a world-class infrastructure system, respectively.

This quarter’s survey was in the field from February 19 through March 7, 2025. In total, 150 CEOs completed the survey. More than three-quarters of responses were submitted before the 25% U.S. tariffs on Canada and Mexico were announced on March 3, 2025.

About the Business Roundtable CEO Economic Outlook Survey

The Business Roundtable CEO Economic Outlook Survey, conducted quarterly since the fourth quarter of 2002, provides a forward-looking view of the economy by Business Roundtable member CEOs. The survey is designed to provide a picture of the future direction of the U.S. economy by asking CEOs to report their company’s expectations for sales and plans for capital spending and hiring over the next six months. The data are used to create the Business Roundtable CEO Economic Outlook Index and sub-indices for sales, capex and hiring. These indices are diffusion indices that range between -50 and 150 — where readings at 50 or above indicate economic expansion, and readings below 50 indicate economic contraction. A diffusion index is defined as the percentage of respondents who report that a measure will increase, minus the percentage who report that the measure will decrease. The diffusion indices here are then normalized by adding 50 to the result.